This week marks a full year since the COVID-19 lockdown began. Early on in the quarantine period, UCD began a long-term examination of how the lockdown would impact the labor market in the Philadelphia region.

Using Burning Glass Technologies’ real-time job posting data, we looked at new job postings, broken down by industry, and how quickly things were changing from what had, just months earlier, been one of the tightest job markets in recent memory. Over the coming weeks and months, the number of new jobs being posted dropped by 15%, then 30%, then as much as 50% from pre-pandemic levels. As it became clear that these changes would continue for the foreseeable future, we began to share what we were seeing in the Philadelphia labor market on our blog. Now, a full year into the COVID-19 economy, we can start to look back over the past year and see what has happened, where the labor market stands today, and how far we have left to go.

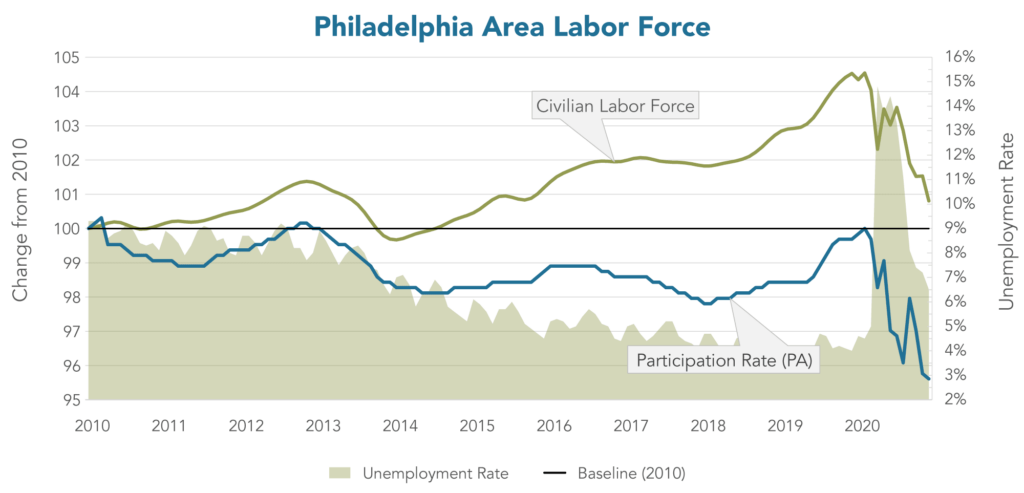

To begin, we can examine just how many people make up our regional labor force. Using 2010 as a baseline of 100, we can see how the number of individuals in the civilian labor force in the region has risen over the last decade, with around 4.5% more people in the pool at the beginning of 2020. When COVID hit in March of that year, nearly half of the gains over 2010 were wiped away, before creeping back up slightly at the end of the summer. In the fall, however, the number of people in the civilian labor force began to drop just as quickly as it had in the early weeks of the pandemic, wiping out nearly all of the gains since 2010. In the early months of 2021, just .5% more individuals were part of the civilian labor force in the region than there were in 2010.

While the raw number of individuals working is still slightly above 2010 levels, the labor force participation rate, or the measure of an economy’s active workforce, was below 2010 levels for most of the past decade. The participation rate began to finally increase in 2019 and in the early months of 2020,, as low unemployment put upward pressure on wages as employers began to compete for talent. However, COVID has caused this to plummet as well. By early 2021, the labor force participation rate for Pennsylvania was more than 4% lower than it was a decade ago, despite increases in the population and the number of jobs available.

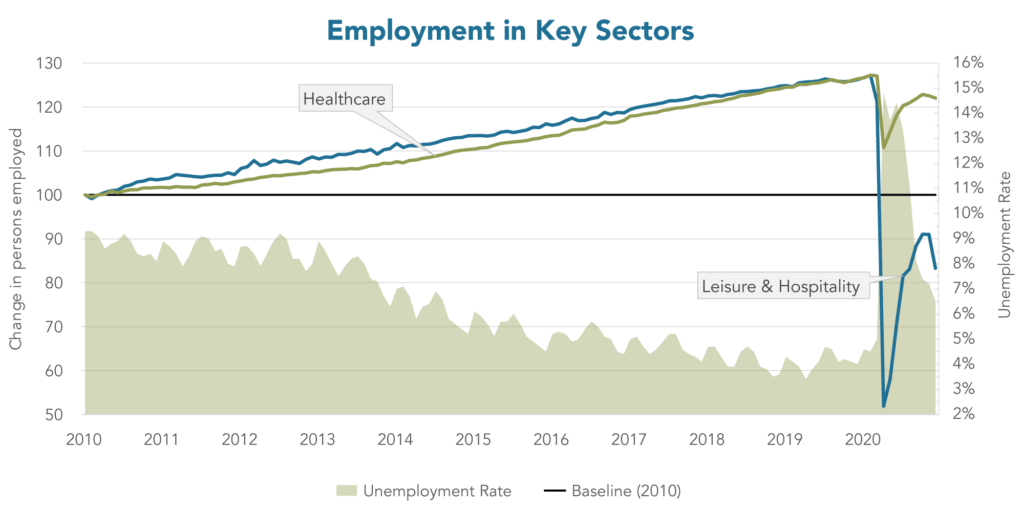

The decline in the number of people working and the labor force participation rate is one way to look at the state of employment in our region. Another is to see how key industries have fared over the past year. The healthcare and hospitality industries are two of the largest contributors of new jobs and employment, with each having expanded the number of people employed in the sector by nearly 25% since the start of the 2010s. However, the impact of COVID-19 on each industry couldn’t be more different.

With world-renowned hospitals and medical centers, the healthcare sector in the Philadelphia region has been one of the fastest growing areas of employment since the great recession of 2008. When the pandemic hit, employment in the sector dropped quickly, as elective procedures were cancelled, and in-person doctor’s appointments moved online. As restrictions were refined and loosened, many of those who had been temporarily laid off or furloughed were able to go back to work, so the total number of individuals employed in the sector is only moderately lower than it was pre-COVID. However, new healthcare job postings are still noticeably low, down 29% from pre-COVID levels. This means that anyone looking for a job in the healthcare field will face increased competition for fewer new positions.

While the healthcare sector has recovered a large percentage of its workforce, the hospitality sector has not. The drop in individuals employed in the industry went from nearly 280,000 in the region at the start of March 2020 to just 183,000 in December, for a drop of nearly 100,000 jobs. Job postings have fallen by a similar amount, with around 50% fewer jobs advertised in the sector in December 2020 compared to pre-pandemic levels. Even in good times, the hospitality sector can be volatile, with many people employed as tipped, part-time, or low wage positions. While outdoor dining and events may begin to return to somewhat familiar levels this summer, it is unclear just how long it will take for the sector to get back to pre-pandemic levels, let alone back to a healthy growth rate.

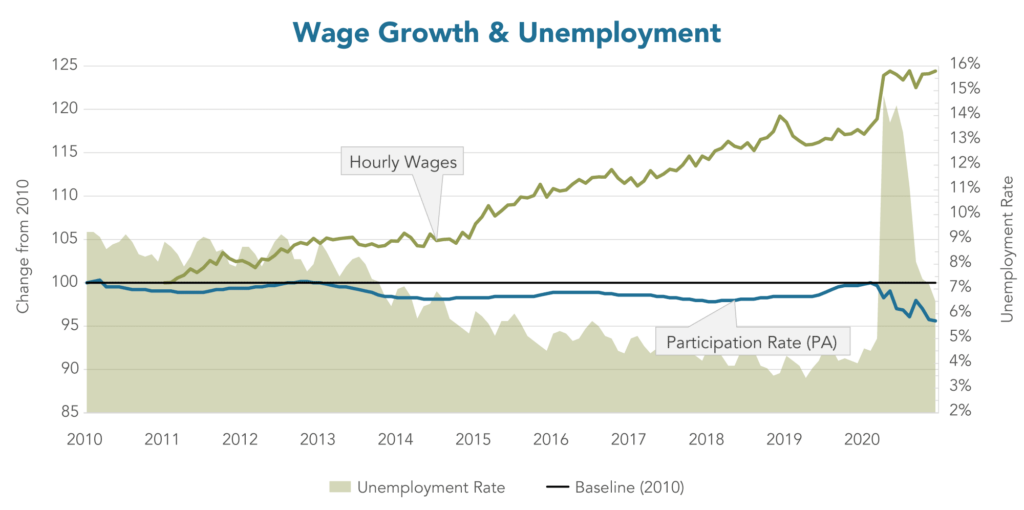

With some sectors hit much harder by pandemic-related shutdowns, the average hourly wage paid to workers has also rapidly changed. It may come as a surprise, but average hourly wages have spiked up since March of 2020. Unfortunately, much of the change is due to lower-wage workers in sectors like hospitality and retail becoming unemployed, while those in knowledge economy jobs have been able to easily transition to work-from-home. By taking so many lower-wage workers out of the equation, overall average wages have soared, up about 10% from pre-pandemic levels. When jobs truly begin to come back, there will likely be increased competition for limited jobs, which may put downward pressure on wages and discourage the long-term unemployed from re-entering the workforce.

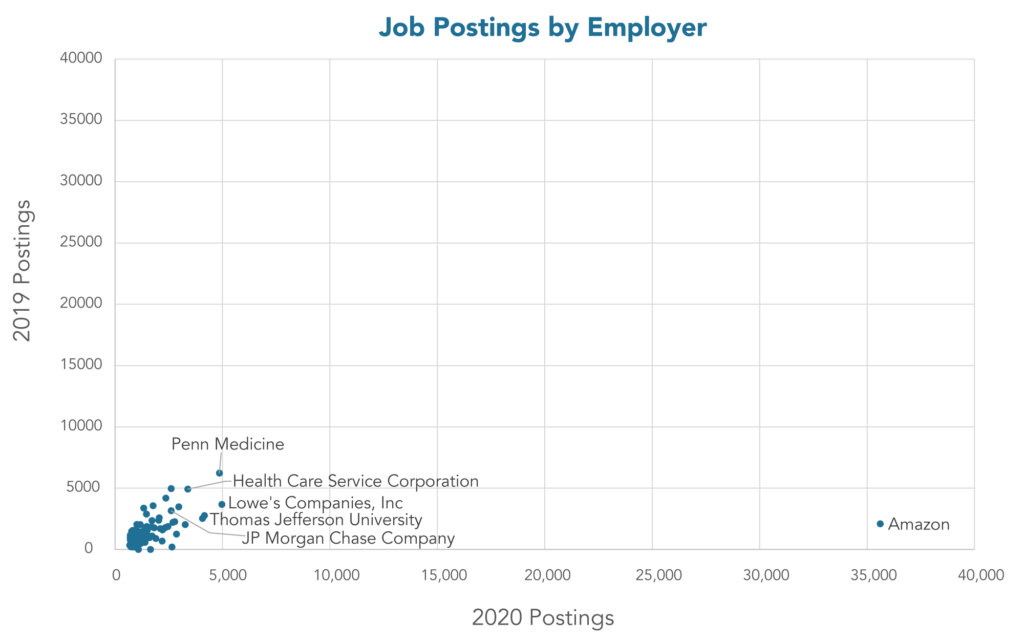

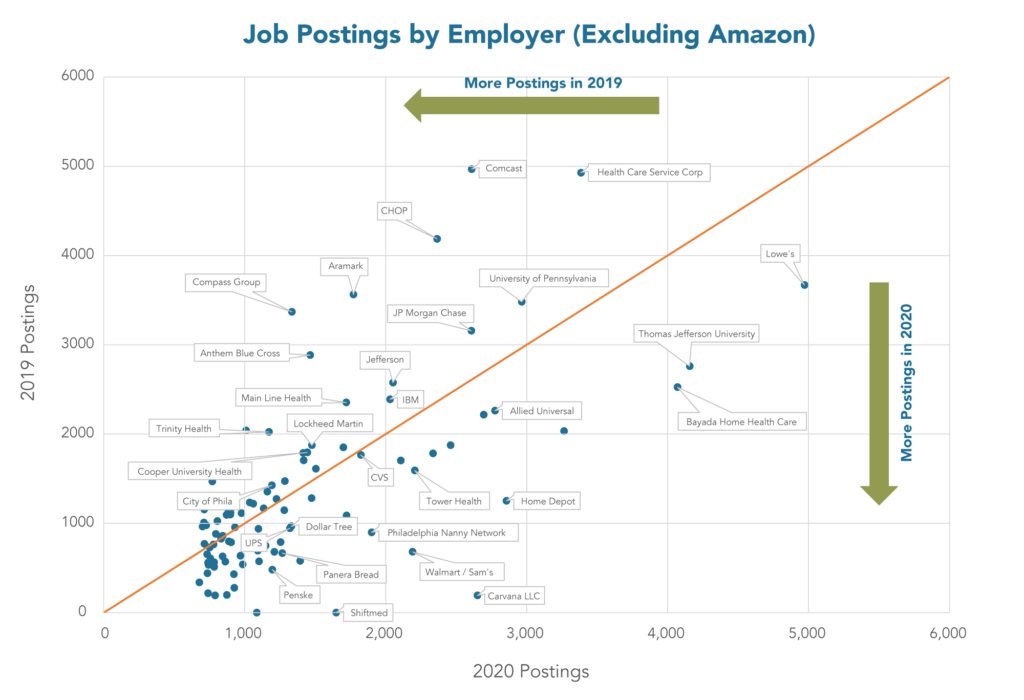

Finally, there has been a dramatic shift in who has been hiring over the past year. Amazon grew exponentially in 2020, posting over 35,000 jobs in the Philadelphia region, a 1,600% increase over their 2019 totals. That represented over 4% of all public job postings in the region.

Looking beyond the biggest players like Amazon, other areas of growth were in big box retail, chain restaurants, home improvement, and delivery services. At the same time, employers focused in the healthcare and technology sectors saw their posting numbers slide in 2020. Many of the new job postings are for jobs that typically offer lower wages, few benefits, or are in sectors that rely heavily on gig work, which often provide less opportunity for advancement or career growth.

Presented as a whole, the state of employment a year into the COVID-19 lockdowns can seem bleak. But there are bright spots, and cause for hope. Consumer confidence and spending remains high, thanks to stimulus checks and expanded unemployment benefits for workers impacted by layoffs. Many of the jobs deemed essential a year ago were in roles that are frequently low wage and underappreciated. COVID-19 has given us a chance to recognize and value the contributions of workers across the economy, which could be harnessed to push for better compensation and working conditions in the coming years. We have also learned that a 9-5, Monday – Friday work schedule at a dedicated office may not be necessary for work to get done. Flexible work schedules and work locations can open up opportunities to many who have previously been unable to work traditional office jobs due to health conditions, caring for family members or children, or transportation barriers.

At University City District, we transitioned our West Philadelphia Skills Initiative to a 100% online program within 6 months of the start of the pandemic. Since then, we’ve are on track to place more people in jobs this year than we ever have before, while the average starting wage for our graduates is also at an all-time high, nearing $17/hour. Alongside partners at the University of Pennsylvania, Penn Medicine, Drexel University, PIDC, and Four Seasons Total Landscaping (yes, that one), we have learned to be able to adjust and do what we do best despite the challenges of the past year. While a disruption on the scale of COVID-19 is unlikely to repeat any time soon, we can take the lessons of the past year as we think about how to build a more robust, inclusive, and competitive local workforce.